By Christina Falso, Staff writer

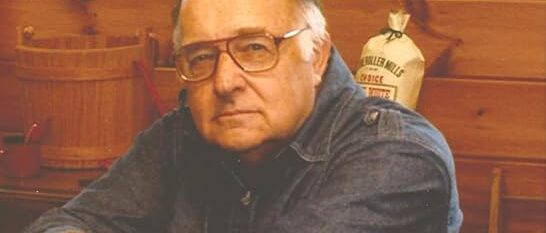

Paul Gerrans, professor of the University of Western Australia, was a guest speaker to students and professors in the business school about financial literacy and advancements regarding this topic on April 18.

Paul worked on Susquehanna’s campus in the business school back in 2007 for a year, before he returned to Australia. Paul explained an in-depth analysis on Financial Literacy and the vitality of Retirement Funds taught on college campuses to undergraduate students.

“It is important for students to know how to manage their finances,” Gerrans said while presenting on this subject.

Financial Literacy is a combination of financial knowledge, skills, attitudes and behaviors when making financial decisions.

Gerrans spoke on the comparisons between Australian students and American college students and their experiences in universities.

As per his talk, in Australia, 71 present of students live at home as compared to America it is much more common to live on campus. For example, here at Susquehanna, only 9 percent of students live off campus. In addition, in Australia the overall tuition fees of a student are split between the government and a student. As in the U.S., students often have to take out loans to pay over a period of time. Gerrans said that this is why it is so vital for students to learn how to manage money, the importance of financial stability and understanding of financial literacy before graduation.

It has been said to complete a finance course can make students overconfident in themselves and when making financial decisions. However, Gerrans reassured students and faculty throughout the lecture that there is “no evidence of overconfidence in students at all,” and how research shows there have only been positive results.

Gerrans is motivated to expand this course and his financial teachings to not only business students and mostly males, but to non-business majors and to more females. “Personally, I would want a student from the Arts and who is a female to take these courses,” he said.

He wants to expand the range and variety of people, so more students will feel confident when they graduate and know how to control and perceive their money for years to come.